Quicklinks

Top Results

Protecting your finances every step of the way

Anyone can become a target of fraud, but when you are aware of common red flags and remain vigilant, you're more likely to stay ahead of scammers. Our resources are designed to help you recognize the signs of fraud and provide you with tools to stop fraud before it affects you.

Fraud resources

Scammers are always looking for new ways to trick people into sharing personal information. Check out our blogs, how-to guides and security pages to learn how to avoid becoming a victim and how to protect your accounts.

Common fraud example

The practice of trying to scam someone by text is called “smishing.” This is a scam intended to steal your data by convincing you to click a suspicious link, download malware, or respond with sensitive information.

The biggest give away in this example is that Civic won’t text you about suspended accounts. But look closer: The URL – or actual link shown – isn’t even a Civic link.

Sometimes there are other details (misspellings, wrong details, content that seems “off”) that can give away the fraudulent nature of a smishing attempt.

If you’re not sure about the authenticity of a text, you can delete it and block the sender. Prefer to confirm the text wasn't from Civic? Call us at 844-772-4842.

Guarding your money around the clock

This information on detection, prevention and resolution helps you avoid account fraud and identity theft.

Protect yourself online

We work hard to keep you safe when you’re doing business with us. We encourage you to protect your accounts and your identity at all times.

Keeping your data private

At Civic, we are committed to the security of your accounts and data privacy. As part of that effort, you have an important role: knowing the various privacy policies of organizations you do business with, including Civic.

Secure your devices

Security is a team effort that starts with you. Make sure all your devices are access-protected in case they fall into the wrong hands.

Create a secure password

Your first line of defense is a password. Creating a solid password is the most important security control available to you.

Steer clear of fraud

Keep your accounts safe with these resources

Fraud frequently asked questions

What’s the best way to avoid becoming a victim of a “smishing” attack?

Be skeptical! Don't respond to “urgent” and unverified text requests for personal information. Take a moment to ask yourself if 1) you know the sender; 2) the request makes sense; 3) the link is correct or can be verified without clicking.

What should I do if I click on the link and then realize it’s a “smishing” attack?

Contact Civic immediately at 844-772-4842.

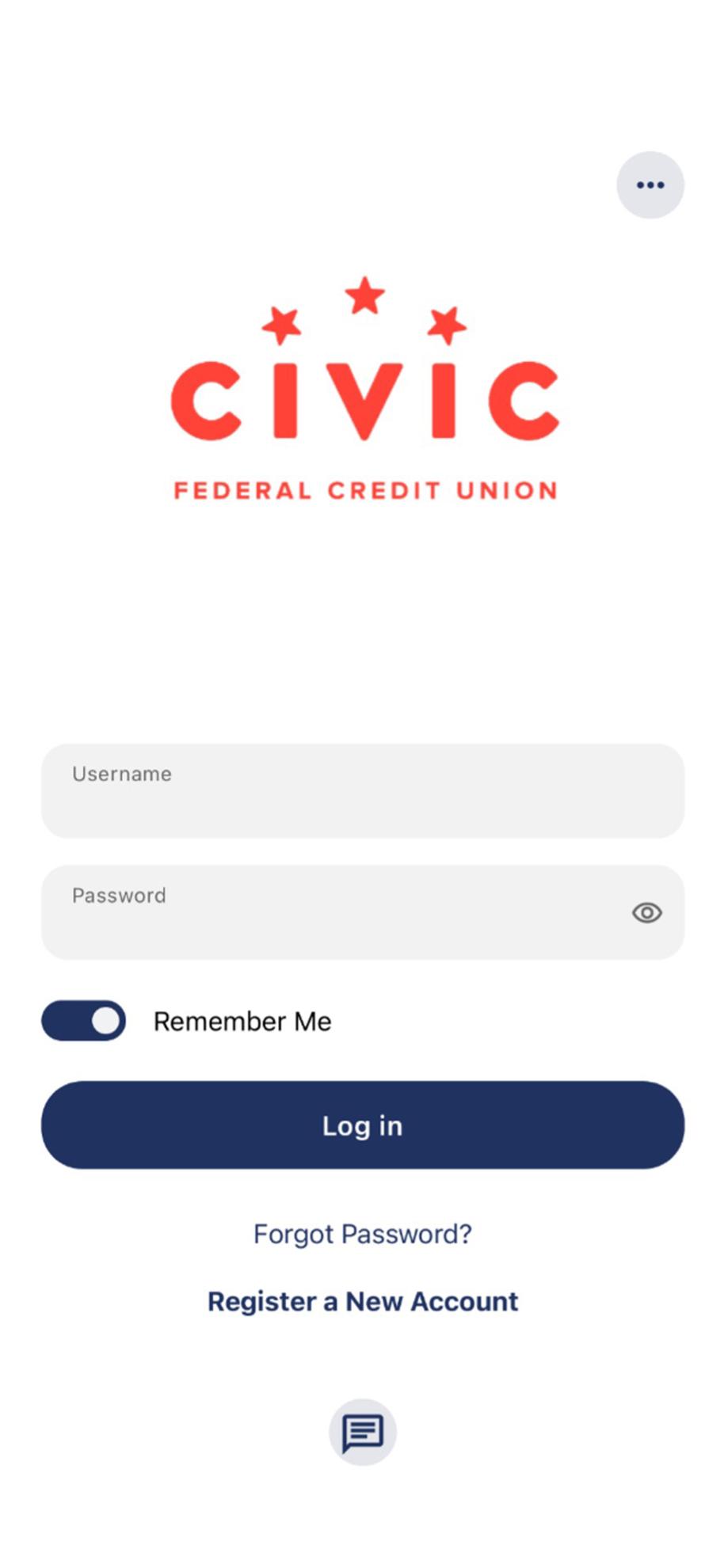

What’s two-factor authentication? Why should I use it?

Two-factor authentication (also known as “multifactor authentication”) helps protect your identity and your accounts. It’s an added layer of security for online accounts that requires two different methods to verify your identity when logging in, using a combination of “something you know” (like a password), “something you have” (like a code from an app), and “something you are” (like facial recognition or a fingerprint). This makes it much harder for hackers to access your accounts.

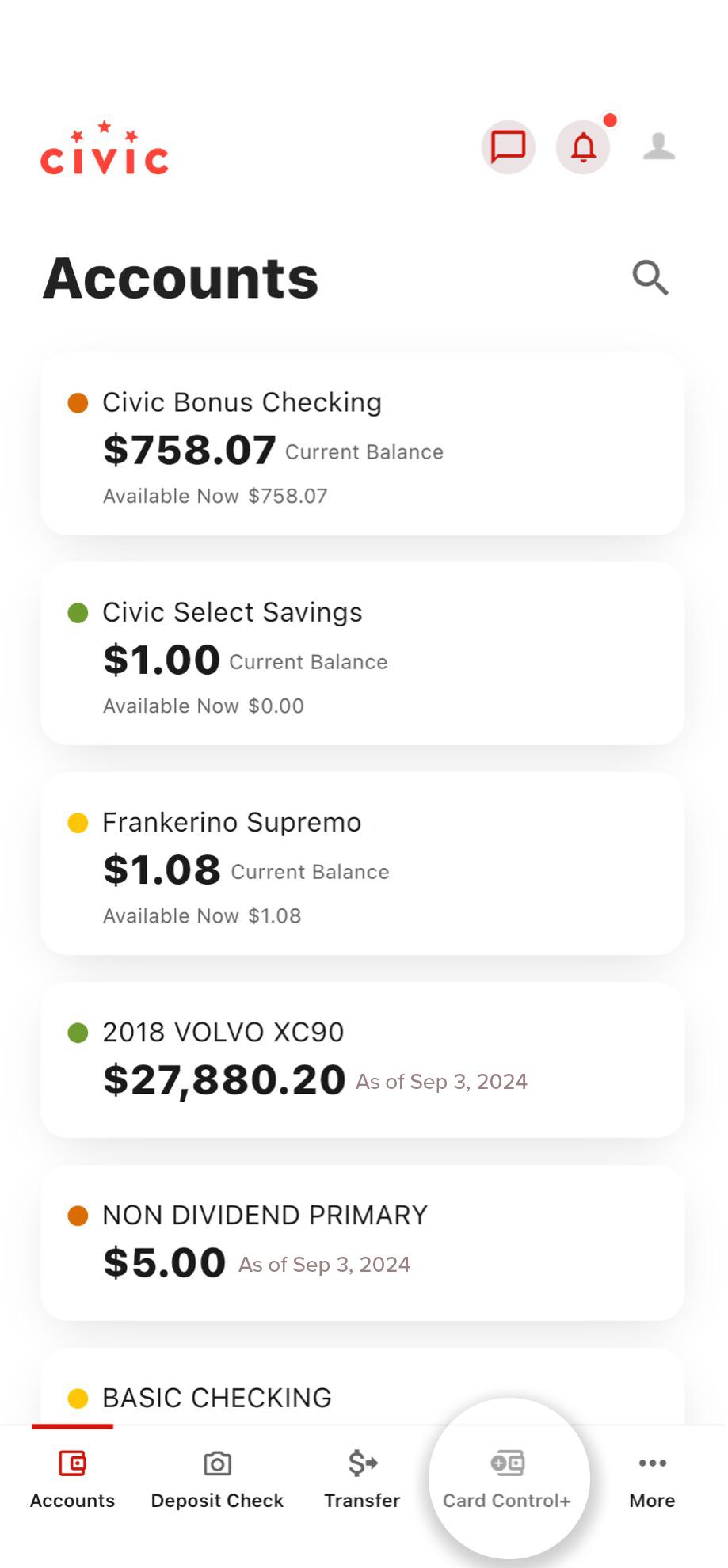

What you can expect from us

- Civic will require that you create a unique user ID and a password that uses a combination of letters and numbers, to log into your accounts

- We may ask you for other information that helps us verify your identity, such as

- Your address and phone number

- The last four of your social security number

- The answers you provided to security questions when you became a member

- Financial products you may have with us

- A code sent to your smartphone to verify you have your phone

We will offer you the opportunity to call us back to verify the legitimacy of our call

We will never ask you for your

- Username

- Password

- PIN

- Full social security number

Our trusted service providers

You may receive communication from these providers. They are legitimate, but always err on the side of caution. If you feel like the communication is not legitimate, please send us a secure message. Visit our guides page to learn how to send a secure message.

Ascensus works with us to help manage member IRAs and HSAs

Credit Union Mortgage Association (CUMA) oversees the administration of our mortgage products

Fiserv provides support for our card systems

Savvymoney delivers our member credit scoring platform

United Solutions Company helps us with debt recovery

Check out these how-to lessons

Check out these how-to lessons

Recommended Articles

The ultimate resource for your banking needs.