Quicklinks

Top Results

Types of Fraud

Learn about common types of banking fraud and how to protect yourself online.

Text message

This is a fake text message that appears to come from your bank or financial institution. It may claim your account has been ‘frozen’, there is a suspicious transaction, or your account information needs updating. The link will take you to a fake website that looks real, but is designed to steal your account information, password, and money.

If you get a scam text message, what should you do?

Ignore

Do not engage or click on any links. Instead, send a secure message in the Civic app1 to verify any Civic issue. For non-Civic accounts, contact your financial institution.

Report

If it is related to your Civic account, immediately contact our fraud department at 844-772-4842. If it is another financial institution, contact their fraud department.

Delete

Once you report it to Civic, take a screenshot and delete the message from your phone.

Block

Take the added step on your phone to block the sender’s number.

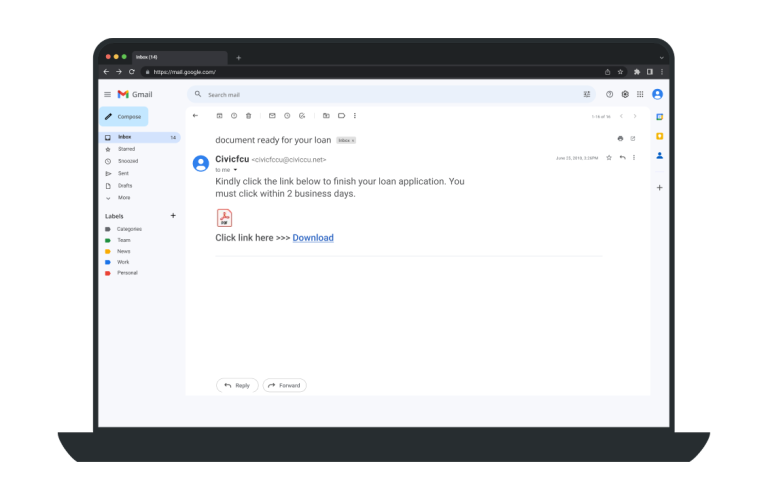

Phishing email

A fake email that appears to come from a legitimate bank or financial institution and designed to trick you into providing login credentials, passwords, and personal information for criminal activity. If you click on a link or download an attachment, you may give them access to your account so they can transfer funds and potentially lock you out of your account.

If you get a phishing email, what should you do?

Identify

Do not click on links or download attachments from unexpected addresses. Look closely at the sender’s email address and the company name for spelling errors that are common in phishing scams. It is okay to read the email, just don’t click a link or download an attachment.

Report

If it is related to your Civic account, immediately contact our fraud department at 844-772-4842. If it is another financial institution, contact their fraud department.

Delete

Take a screenshot of the phishing email and only save the actual email message if directed by Civic or your financial institution. Otherwise, delete the email message from your email account.

Block

Enable two-factor authentication and regularly monitor your accounts.

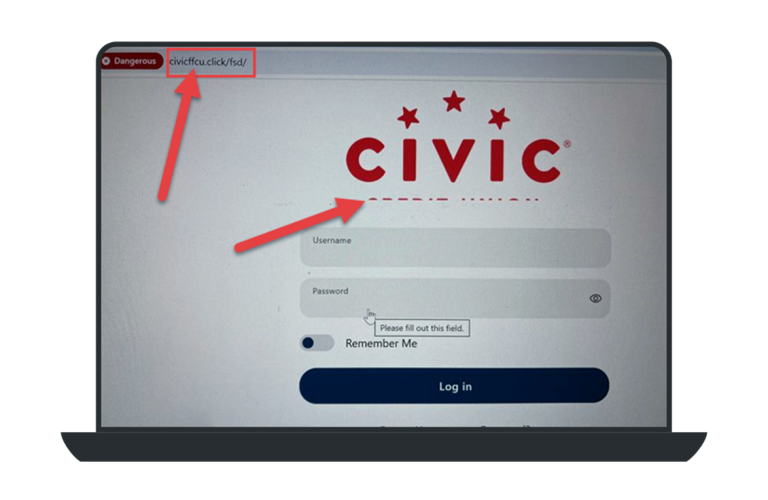

Fake website

Scammers create a fake website that looks close enough to your legitimate banking institution. This tricks you to enter highly sensitive financial account information on the fake website for scammers and criminals to use against you. Fake websites can look real at first: civcifcu.org not civicfcu.org or bankofamrica.com not bankofamerica.com. Fake websites can also appear in online searches with phishing links designed to bait you.

If you find a fake website, what should you do?

Check

Treat the site as suspicious. Check the website address CLOSELY. Once you find the typos in the website address, you will know it is a fake website. Never click on fake website links. If you accidentally click on a link, report it to Civic immediately.

Report

If you determine it to be a fake Civic website or clicked on the website, immediately notify our fraud department at 844-772-4842. If another financial institution is involved, contact their fraud department.

Official

Bookmark and use the official Civic online banking website (civicfcu.org) and always use the secure, official Civic app. We use SSL/TLS encryption technology to keep your information safe; you can be sure of this when you see "https" and a small, closed padlock icon in your browser window.

Secure

Update passwords and enable two-factor authentication.

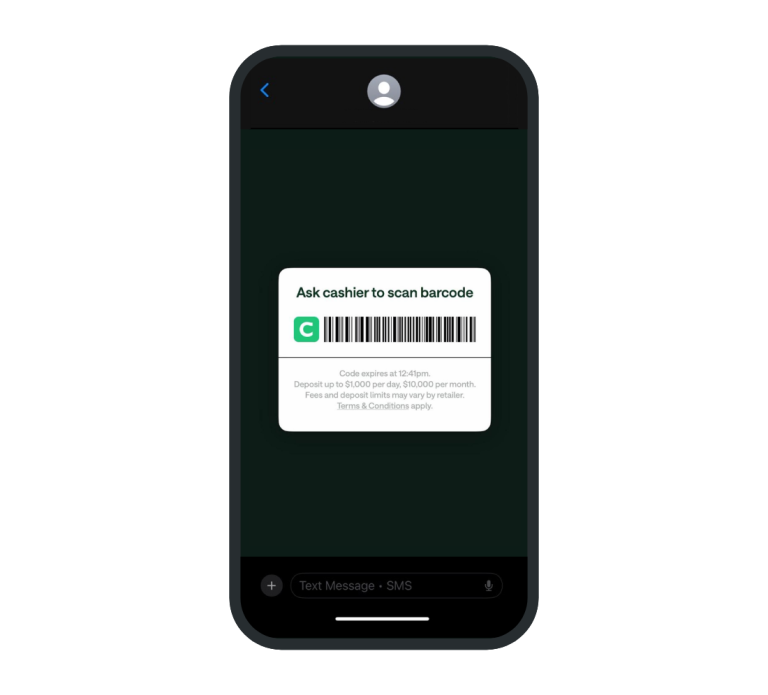

Barcode Deposits

This scam is a fake barcode that tricks you into depositing cash into a scammers bank account, instead of your account. Civic will never email or text you a barcode, ever. Your Civic app-generated barcode is used to make cash deposits at retail locations.2

What should you do if you receive a text or email with a barcode and urgent instructions to use it?

Ignore

Do not scan the barcode, no matter how urgent it sounds. Only use your Civic app to generate a unique-to-you barcode for retail cash deposits.1 The Civic app-generated barcode can be used for cash deposits at retail locations such as Walgreens, CVS, Sheetz, and more.

Report

If it is related to your Civic account, immediately contact our fraud department at 844-772-4842. If it is another financial institution, contact their fraud department.

Delete

Remove the message from your phone or email account to prevent accidental use in the future.

Secure

If you accidentally scanned a fake barcode, immediately notify Civic’s fraud department, enable two-factor authentication on your email account, and change your online banking password.

Protect your accounts

Learn ways to stay ahead of scammers and fraud. Most important, knowing the facts about fraud can help prevent you from becoming a victim of online scams.

1 Message and data rates may apply.

2 Add up to $1,000 per transaction and up to $2,500 per day, per person; limits are determined by the retailer and may vary by location. Minimum deposit is $20. Keep the receipt as proof of transaction. Funds may take up to an hour to appear in your account. There are no fees for using this service.