Quicklinks

Top Results

Firefighters

Join a credit union for firefighters as dedicated to service as you

The Fire debit card that gives back

As champions of firefighters from the very beginning, we offer the Fire debit card. So, choose the Civic Fire debit card to show your pride in service while supporting the NC State Firefighters’ Association (NCSFA),3 at no cost to you.

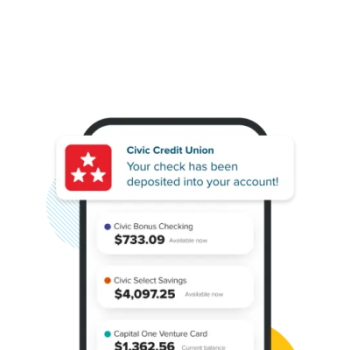

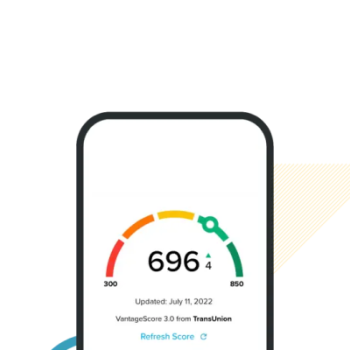

Life is digital

So are these everyday financial tools

More to explore

We think this could be helpful too

Used Auto Loan

Make your next used vehicle loan as affordable as possible with low rates, flexible payment options, and up to 7 years to pay off the loan.

- Flexible used vehicle financing up to 84 months (7 years)

- Used auto loan rates as low as 5.25% APR¹

- Easy loan application, fast approvals

- No pre-payment penalties

Business Term Loans

Small Business Term Loans can help you solve your short-and long-term business financing needs with no pre-payment penalties.

- Secured business term loan has minimum loan amount of $10,000

- Secured loan terms range from 1 year to 10 years

- Unsecured business term loan has $1,000 loan amount minimum

- Unsecured business term loan terms are up to 3 years

Join the credit union for firefighters

Be served by a team that understands your passion for service and the financial journey that comes with it.

1 Message and data rates may apply.

2 Minimum opening deposit is $25. Dividends are compounded daily and paid monthly. Funds may be used as collateral for lending. Service fee of $1 each month balance is below $25.

3 Civic donates 50% of its share of net merchant fees directly to programs sponsored by NCSFA.

Recommended articles

The ultimate resource for your banking needs