Quicklinks

Top Results

Law Enforcement

This credit union for local law enforcement officers is your financial partner, and always has your back

Advance your career with professional development scholarships

You can also advance your career when you apply for professional development scholarships to the Administrative Officers Management Program and Law Enforcement Executive Program offered through North Carolina State University’s Public Safety Leadership Initiative.

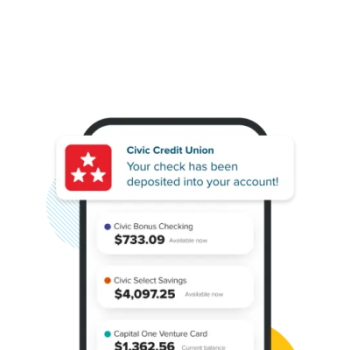

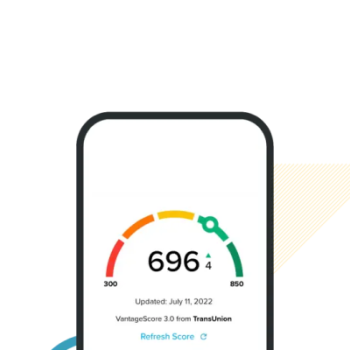

Life is digital

So are these everyday financial tools

More to explore

We thought these may be helpful, too

Join a credit union for law enforcement

Get affordable rates to manage and strengthen your financial life

1 Message and data rates may apply.

2 Minimum opening deposit is $25. Dividends are compounded daily and paid monthly. Funds may be used as collateral for lending. Service fee of $1 each month balance is below $25.

Recommended articles

The ultimate resource for your banking needs