About Us

Focused on you, every day

Because your financial life is more than money. It is access, opportunity, and community strength where you live.

We bring people and technology together, delivering affordable financial products for a better life for all North Carolinians.

We're making positive impacts across North Carolina, serving local government, guiding members to define their own version of prosperity, and helping to build healthy, thriving communities for today and tomorrow.

People first

Our mission is people, not profits. It’s in our DNA. Civic Federal Credit Union is committed to helping local communities thrive.

We do this by serving local government through equitable lending, supporting local initiatives, and funding small business growth.

Planet always

As a financial cooperative focused on local government and the communities of this state, we strive to lessen our environmental impact. We support and encourage initiatives to preserve natural resources for today and for generations to come.

Prosperity for all

We are a member-centric financial institution supporting all North Carolinians by helping to build strong communities. Our commitment is to identify the ways we can use finance for the greater good, building prosperity for all of us.

Our history

We use past success as a source of inspiration to push forward and do more.

Civic completed the LEED Certification program to demonstrate a commitment to sustainable building design and construction practices.

Renovation completed of former WCPS building.

Since its inception, Civic seeks to use both its platforms and resources to amplify local governments' work to serve communities.

Funded research to identify and remedy community issues.

Civic is working to redefine equitable access to financial opportunities for North Carolina residents and businesses.

Deposit and loan options are now available for consumer and business entities.

Challenges facing marginalized communities allow Civic to serve those that are underserved in new and innovative ways.

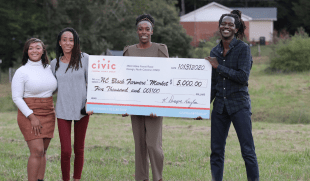

Partnership to address the agriculture needs of the black community.

During the second year of the pandemic, we focused on serving the local public health and environmental needs of communities.

Civic headquarters transformed into a community vaccination site.

This level-two EV charger is for anyone to use and located in front of Civic’s Raleigh headquarters near the new community bus stop.

In partnership with LGFCU, this foundation will bridge local NC gaps for housing, health care, human services, and hunger to help create solutions.

Move to LGFCU's independence from SECU and shift to Civic scheduled for 2024

Civic continues to show commitment to sustainability, installing solar arrays on its rooftop

NerdWallet names Civic to its list of best "Socially Responsible Banks"

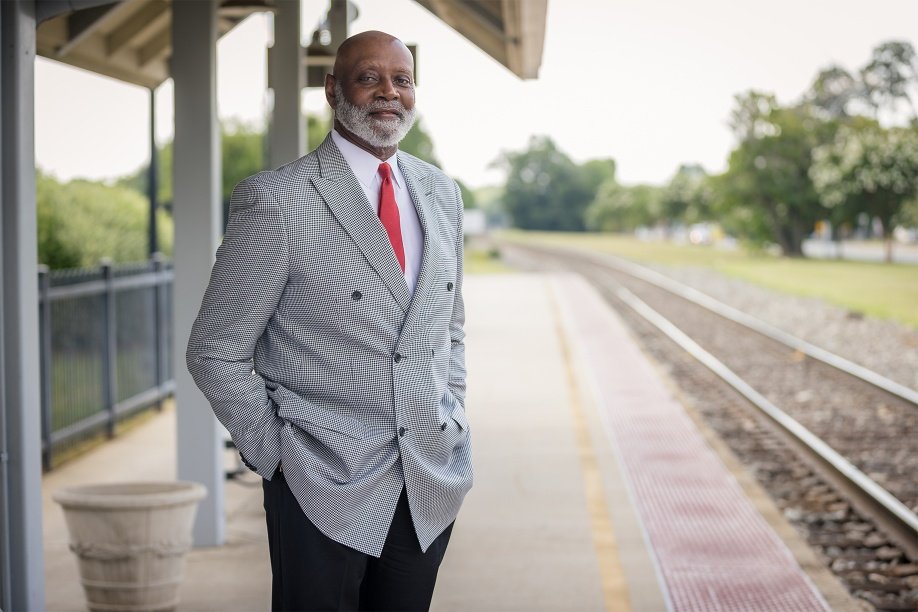

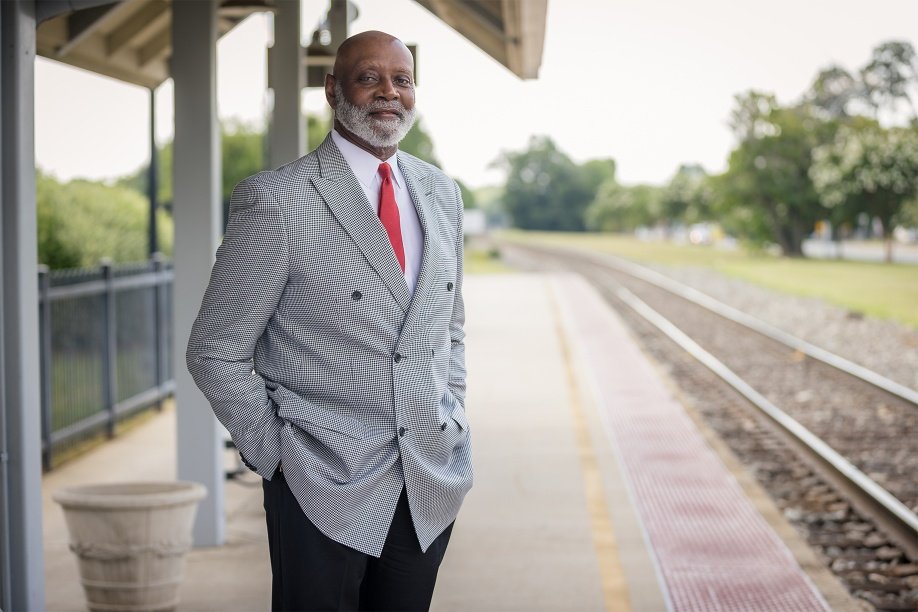

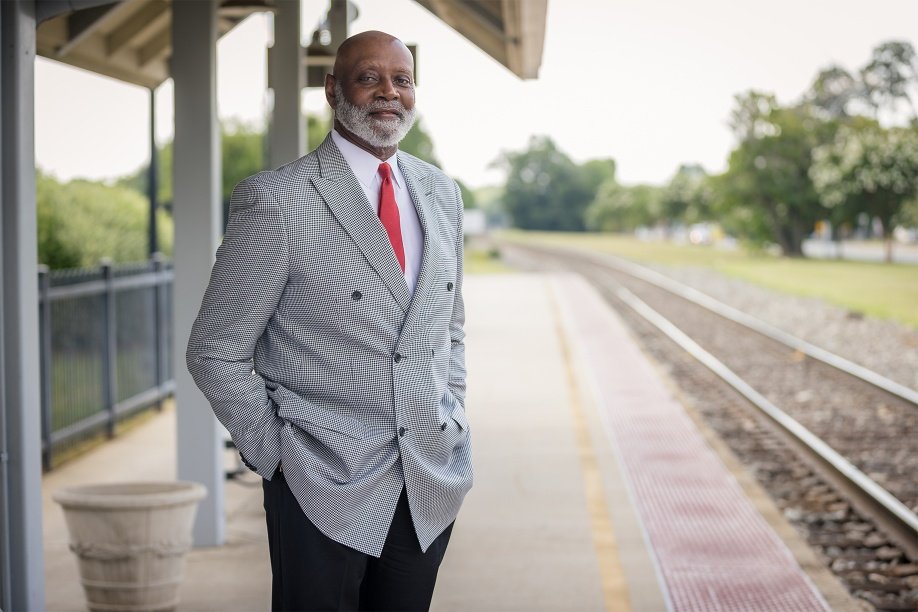

Dwayne Naylor is named CEO of Civic and Local Government Federal Credit Unions

Civic reaches milestone of 7,000 members

Additional sustainability efforts for Civic include the addition of honeybees

Plan is unveiled for future member channels, including Civic branches

Civic adds mortgages to its growing product list

Civic 2024+ Strategic Plan

Our 2024+ Strategic Business Plan is the blueprint for our future. It shares our vision, describing how we'll serve local government today and in years to come, and details how our operating model is rooted in values-based banking.

Board of Directors

Our volunteer board members serve you best because they come from local government and have worked in communities across the state.

Jeanne Erwin

Chair

Dr. Aaron P. Noble Jr.

Vice Chair

Lin Jones

Secretary

Kellie Blue

Treasurer

Ruth Barnes

Board Director

Paul Miller

Board Director

Tony Brown

Board Director

Jeanne Erwin

Chair“I serve on the Board because I feel I'm able to help improve the lives of our members. All the decisions that we make are, in some way, doing just that. That's what we do first and foremost.”

As a fiscal leader throughout the Triangle region, Jeanne Erwin brings deep municipal experience to her role as Board Chair, and a strong commitment to North Carolina communities.

A rewarding career

Erwin knows local government. Throughout her career she has served North Carolina in leadership capacities for the City of Raleigh, Town of Chapel Hill, Durham Public Schools, and Office of the State Auditor as fiscal manager, accounting manager/assistant finance officer, and auditor. She holds the designations of Certified Public Accountant (CPA), and Certified Government Financial Manager (CGFM).

Describing the expansive impact of working in finance, Erwin says, “I was able to work with all the different departments, whether fire or public safety, public works, or community development, and that was very rewarding, because I knew that those departments were in turn helping all the citizens in some capacity. And so I felt like I was able to help them to touch the citizens.”

In addition to her local government experience, Erwin has been a longtime advocate for the credit unions. She began her service with LGFCU in 1994 by serving on the LGFCU Supervisory Committee, where she served as Chair until being nominated to the Board of Directors in 2008. She has since served on both the credit unions’ Board and Supervisory Committees, earning the Certified Credit Union Board Member (CCUB) designation. Erwin also served as Chair of the subscriber group that organized and chartered Civic Federal Credit Union.

Erwin earned a Bachelor of Science degree in business administration/accounting from the University of North Carolina at Chapel Hill. She is also a member of AGA, (formerly the Association of Government Accountants), and has served in several roles including Triangle Chapter president, senior vice president, and national treasurer.

Member focused

When asked to describe her commitment to local government in three words, she lists: fair, treating everyone the same without favoritism or discrimination; concerned, caring for the needs of our members; and responsible, capable of being trusted and morally accountable.

Erwin is especially driven by her passion for helping members feel secure in their financial futures, explaining, “I feel like I am able to help members, maybe be more optimistic about their financial well-being, and it takes some of the stress off of them.”

Looking to the future

I hope that we will be recognized as a leader in the credit union industry, because I know we're light-years ahead of most credit unions in what we're trying to do.”

As LGFCU approaches its independence from State Employees’ Credit Union, Erwin’s confidence in our credit unions is unwavering. She explains the importance of independence, and what this change means for how our credit unions service members.

“Being able to meet all the needs of our members means being able to make our own decisions and move in our own direction,” she says. “And to have our own offerings of products and services without limitations.”

Erwin also recognizes how our credit unions’ unique mission and purpose help us make a lasting difference in our communities. She names Civic’s values-driven mission — putting people and prosperity first — as its strongest differentiator.

“That makes us stand out,” she says. “We’re not about profit. We’re about helping people. I’ve been to other credit unions, and I haven't felt the same culture. That sets us apart. I also love the fact that we’re helping the planet.”

Civic is an associate member of the GABV (Global Alliance for Banking on Values), and Erwin currently serves as a governance member.

Dr. Aaron P. Noble Jr.

Vice ChairAs a municipal leader, Dr. Aaron P. Noble Jr. characterizes his career as, “one of adventure, achievement, and personal satisfaction.” He served North Carolina’s local government for 32 years: a decade as the City of Burlington’s public information officer — the city’s first — and the remaining time as its human resources director. Noble’s extensive career inspires his commitment to the community he knows best. He says, “One of the things that really excites me about our credit union is serving a population that is near and dear to my heart: local government employees in North Carolina.”

Getting started

Having earned a Bachelor of Science degree in communications from Hampton University; a Master of Public Administration degree from the University of North Carolina at Chapel Hill; and a doctorate in education from North Carolina State University, Noble brought his expertise to the credit unions.

He has served as a credit union volunteer since 1997, first as a member of the LGFCU Northern Piedmont Advisory Council. Later, he served on the Loan Review Committee for several years, prior to his appointment to the LGFCU Board of Directors in 2011. In 2018, Noble served with the subscriber group that organized and chartered Civic Federal Credit Union.

Credit unions and community

Dr. Noble speaks to the impact local government employees and volunteers have in their communities: “From making sure their neighborhoods are safe and clean, making sure they have recreational opportunities, putting together policies that help shape the growth of their community going forward … these people contribute in so many ways — they're hardworking people.”

His respect for his community is exemplified in his work. Having served on a local bank board before joining the credit union, he understands the important differences between the respective bottom lines of banks and credit unions.

[The bank] was all about making sure the stockholders were getting their benefits first,” he says. “Credit unions are not about looking out for stockholders, but the members.”

Service, reliability, accessibility

With the merger of LGFCU and Civic, Noble believes the credit union will be able to offer much more to members. He recognizes the importance of making sure members feel confident doing business in new ways, and knows the credit union will take security, service, reliability, accessibility, and financial literacy seriously.

“That's what it's really all about, people helping people,” he says. “We're going to have even greater efforts now in educating our members and helping them to better manage their finances, and helping them to better prepare for the future.”

Trustworthy, dependable and caring are words to describe the legacy Noble wants to leave. He takes pride in the reputation he’s established in his city, as someone who stands by his word and genuinely cares about his community, and his commitment to North Carolina local government is unwavering.

Lin Jones

SecretaryAs a fiscal and service leader, Lin Jones characterizes his career as “seeing both sides—reporting to the board and being on the board. I started with a CPA firm and when I decided to do audits and government accounting and started reporting to boards, I got a deeper understanding and appreciation of how local governments work.”

Getting started

Jones credits his passion for working with North Carolina communities to his introduction to working with local governments at an accounting firm early in his career. In that role, he conducted audits and was responsible for municipal accounting. The experience gave Jones an up-close look at the inner workings of municipalities. His affinity for local government deepened once he moved into finance, where he was responsible for all functions from accounts payable and reporting to payroll and investments. Jones served, as finance director for the Town of Garner until retiring from the position. He is a graduate of Appalachian State University.

During his career, Jones has leveraged strong research and reporting skills to help identify and drive solutions to challenges. Jones described one of his most significant career accomplishments: “It was the conversion of two city accounting systems, one in Durham and the other in Garner.”

Credit unions and community

Jones believes in the positive impact that Civic can make in the lives of North Carolinians, and stresses the importance of listening to the community to help inform decisions.

We have very personal relationships with our members, and truly want to improve their lives. Our Advisory Council is unique to our credit union – we bring in individuals as a sounding board.”

He first served the credit union in 1991 as a member of the Advisory Council. He was elected to the LGFCU Board of Directors in 1996, serving in all of its officer positions, including Chair. In 2018, he saw the opportunities that Civic’s mission would provide North Carolinians and is one of its charter members.

Future focus

An issue of critical importance to Jones is financial literacy—a hallmark of his 30-plus years of credit union and community service. One memorable program helped high school students better understand budgeting and basic financial concepts, such as balancing a checking account, before they graduate. “Either people don’t have the resources, or they don’t manage their resources, such that they live paycheck to paycheck.”

Looking ahead, Jones believes two of the most important issues facing members that the credit union can help address are affordable housing in partnership with the government, and financial literacy in schools. “There is a lack of financial education. People don’t know what to do with their finances. And there are kids who have no idea what it will be like after college.”

When it comes to credit union independence and the merger of LGFCU and Civic, Jones believes it will benefit members in many ways including new products, policies and rates. “In the past, there was a sameness to the loan policies and products—if they did it, we did it. With independence, we will have the freedom to make decisions that are in the best interest of our credit union, not anyone else.”

Kellie Blue

TreasurerThe power of connecting with people through common experiences and stories is a hallmark of Blue’s career in service. It is her dedication to excellence and grit that has shaped her leadership and governance style: “If you make a commitment, you have to do it with excellence,” she says. “Give of yourself and be your best. Don’t just be a placeholder.” She lives this every day and this dedication has helped her to lead organizational vision and educational initiatives and to manage financial systems and budgets.

Getting Started

Blue’s local government career and statewide board service is reflective of her grace and determination to make a difference for others. She serves North Carolinians from Robeson County, her birthplace, as County Manager. Prior to that, Blue held consecutively advancing roles with the county including Assistant County Manager, Finance Director, and Assistant Finance Director. “I couldn’t do what I do now without coming up the ranks in Robeson County.”

She has served on the Local Government Federal Credit Union’s (LGFCU) Eastern Sandhills Advisory Council, the Advisory Board of LGFCU, and the LGFCU Board of Directors from 2012 through 2018. In 2018, Blue left the LGFCU Board to help organize and charter Civic Federal Credit Union, and become one of its first members.

Commitment to community

Her board service focuses on education, finance and local government—all with significant contributions to her local community and state. Specifically, Blue serves as Treasurer for the Civic Board of Directors and is also on the Civic Local Foundation Board. She is also the Vice Chair of the UNC School of Government Board of Directors and Chairs the Committee on University Governance, a position to which she was twice elected (2017 and 2021). She is actively involved with local Councils of Governments in Robeson, Hoke, Scotland, Bladen and Richmond counties. Blue is a member of the Lumbee Tribe of North Carolina and is a graduate of University of North Carolina at Pembroke.

Future Focus

Blue strongly believes in the credit union model to help make a difference in the lives of others. She says Civic stands apart from other financial institutions because of the, “willingness to go above and beyond. It matters, to go the extra mile and help customers and clients. In most places, people just become a number – there is no relationship.”

Looking to the future of the LGFCU and Civic merger, she believes there are “unlimited opportunities for Civic to get to the next level and to best serve our community.”

Ruth Barnes

Board DirectorThere’s no challenge too big and no task too small for Ruth Barnes to tackle, when it comes to helping or empowering people, especially credit union members.

The starting point

Barnes developed her disarming personality and tenacity during her 25-year career as the finance director/information systems officer for the Wake County ABC Board. There she was the only woman on the team, doing the job of three people — managing finances, human resources, and store technology, while coordinating real estate deals.

Barnes’ reputation preceded her in 1984 when she attended the first Annual Meeting for Local Government Federal Credit Union. By the time she left the meeting, she was selected as Chair of the credit union’s Supervisory Committee, a position she held until being elected to the Board in 1990.

The opportunity to help her employees and fellow credit union members keep up with their finances was her main reason for joining the Board. She has since served in all Board officer positions including Chair, and is the currently Chair of the Asset Liability Management Committee.

After retiring from the ABC Board, Barnes went on to become a licensed real estate broker. Since then, she engages with and serves local governments and individuals, to meet their commercial and residential needs. Barnes has also served as a former commissioner for the Atlantic Beach Town Council.

People helping people

Because of her strong dedication to the credit union and its mission of “to improve the lives of members,” Barnes dug deeper in her involvement by becoming one of the founding members of Civic Federal Credit Union. She has been on its Board since that credit union’s beginning in 2018. The North Carolina State University graduate uses her accounting knowledge and her real estate experience to help guide both credit union Boards.

Her growth and commitment to the credit unions has grown even stronger over the years. Barnes believes Local Government and Civic Federal Credit Unions stand apart from banks and other financial institutions because of, “our commitment to local government, our communities and the people who work in local government. The credit unions appreciate what local government employees do. It’s caring for our fellow human beings.” In addition to her work with the credit unions, Barnes serves on the board of Civic Local Foundation, the credit union’s nonprofit aiming to address housing, healthcare, human services and hunger in North Carolina communities.

Barnes also started the North Carolina Chapter (Sister Society) of the Global Woman’s Leadership Network, a credit union organization helping women to thrive and prosper in North Carolina and all over the world. Barnes credits this as her biggest accomplishment.

Future focused

Barnes believes the credit unions should be positioned to address people’s ability to navigate this challenging economy, with its high interest rates, limited income for investments and limited income to meet day-to-day needs, and financial literacy to help members with budgeting and securing competitive loan rates.

For Barnes, the future of the credit union looks bright.

We came up with Civic as a solution, so we could keep our business accounts,” she says. “Now we strive to take over our own future, to serve the coming generations the way they want to be served.”

Paul Miller

Board DirectorA tireless visionary who demonstrates compassion and helping those who need help are some of Paul Miller’s key strengths by which he lives.

A commitment to service

Service to others. Leadership by example. These are characteristics that Paul Miller has consistently demonstrated throughout his professional and personal life. It’s a legacy that he will leave to those whose lives he’s touched, whether in partnership or as beneficiaries of his community outreach.

As an accomplished executive in the private sector, the fire industry, and within state and local governments, Miller brings decades of experience to his role on the Board of Directors.

Credit union commitment

Ask Miller why he serves as a credit union board member, and he’ll tell you it’s because,

the credit union is just like those folks I love in the fire service. It's an organization that serves the underserved. It serves the people who really need to be served. And it works to improve the lives of the members.”

Miller’s commitment to both credit unions is demonstrated in his service as a volunteer board member for more than 20 years.

His credit union journey started with LGFCU in 1999, serving on the Eastern Carolina Advisory Council. From there, he joined the LGFCU Board of Directors in 2000, and has served as Board Chair and Chair of the Compensation Committee.

He became one of the first members to join Civic in 2018, and served as Vice Chair of its inaugural Board. He continues to serve on the Civic Board, helping to guide Civic into becoming one of the fastest growing credit unions in the country, a digital-first credit union positioned to offer financial services across North Carolina, especially in areas considered banking deserts.

Because of his vision and commitment to the credit unions’ values of people, planet and prosperity, Miller is credited with encouraging credit union leadership to secure and install publicly accessible electric vehicle charging stations at Civic headquarters in Raleigh.

Future focus

Miller believes that the credit union’s future focus should address food insecurity, broadband access for rural North Carolina counties, and financial literacy. Through our credit unions and our nonprofit, Civic Local Foundation, we should be prepared to address the issues affecting our community members – beyond financial services.

Work+Life balance

Ask Miller about his most significant career accomplishment, and he’ll tell you it’s his children. He and his wife, Caroline, raised “three great kids.” Their grown children, as well as their grandchildren, have followed the couple’s tireless work ethic and commitment to serve. For the Millers, service is a family affair.

After graduating from North Carolina State University with a Bachelor of Arts degree in political science, Miller started his professional career working for 22 years in a private family business in his hometown of Snow Hill, North Carolina. During this time, Miller served many years on the Snow Hill Town Board and one term as a Greene County commissioner.

Miller went on to make his mark in North Carolina’s fire service as a deputy fire chief, and as the only fire instructor in Greene County until the program could be expanded. He also served as an EMS instructor alongside his wife.

Miller later moved on to the North Carolina State Firefighters’ Association (NCSFA), where he started in 1990 as the assistant executive secretary. He went on to become executive director of the NCSFA, where he worked for 23 years before retiring in 2013. It is an experience that yielded perhaps some of the most significant impacts for North Carolina’s firefighters.

Under his leadership, the Association worked to strengthen the benefits for firefighters, to address the health concerns they face as part of their job. His efforts served as a model for creating and packaging health benefit offerings for firefighters across the country. He also built one of the biggest benefits summits and conferences in North Carolina, and created one of the largest state firefighters’ conferences in the United States. Miller sees his impact in the fire community as one of his most memorable accomplishments.

As a retired NCSFA executive director, Miller currently serves as its executive director emeritus. He is also active on the board of directors for the fire department.

Tony Brown

Board DirectorWith nearly 30 years of local government experience, Tony Brown brings a wealth of knowledge to his role on the Board of Directors for both Civic and Local Government Federal Credit Unions.

A COMMITMENT TO SERVICE

Brown began his service with LGFCU in 1998 as a member of the LGFCU Roanoke River Advisory Council before joining the board of both credit unions in 2022.

Brown says he felt drawn to become the newest credit union board member, because his “personal goals and life’s work align with the credit unions’ mission ‘To improve the lives of members.’”

The University of North Carolina-Pembroke graduate began his career with four years of active duty in the U.S. Air Force and was an active member of the Air Force Reserves. He then worked in local government in Orange County before ending up in Halifax County, where he spent most of his career, retiring as Halifax County Manager. Brown credits being the County Manager for 15 years as one of his most significant career accomplishments. He was the County’s longest serving managers even exceeding the national average.

Brown will tell anyone that his “work in local government was enjoyable because I can see the positive changes and differences I’ve made that affect people’s lives, especially in rural Halifax County.”

PAYING IT FORWARD

Brown is a longtime member of the credit union and remembers how the credit union helped him buy his first car and assisted him when he needed it most.

“My work on the credit union boards is a good extension of what I've always done in my career. Now I get to pay it forward,” says Brown.

Credit unions are a family. The connection with the members — serving people over profits — helping members understand and be prepared for the changes that are coming.”

FUTURE FOCUS

Brown believes the credit unions should be positioned to help North Carolinians move toward a better quality of life by:

- Being innovative and charting our own course to address members’ needs.

- Continuing to engage with members, seeking continual feedback on what works or needs improvement.

- Educating members on how to be safe online.

"We look forward to having you join us at the start of this journey that will mean so much for the hardworking, dedicated people who make up North Carolina's local government community."

A passionate credit union advocate, Dwayne Naylor has worked in the credit union industry for more than 25 years. His focus on the "triple bottom line" — a sustainable enterprise that delivers economic, social and environmental benefits — is what drives the Civic commitment to people, planet and prosperity.

Naylor earned a Global MBA from the Fuqua School of Business at Duke University and a Bachelor of Science from East Carolina University. He is a 2015 graduate of ABA Stonier Graduate School of Banking at the University of Pennsylvania, Wharton. He has earned the Credit Union Development Educator (CUDE) designation and is a Certified Chief Executive.

Naylor has two children, is married to his best friend, and enjoys reading in his spare time.

"Civic is excited to serve those who serve North Carolina. As you work tirelessly to smooth the paths of fellow North Carolinians, Civic is prepared and ready to smooth your financial path. We are here for you!"

Garland Avent is Chief Financial Officer (CFO) of Civic Federal Credit Union. As CFO, Avent is responsible for oversight of the Finance and Accounting functions of Civic. He also participates in the development of the Credit Union's annual financial plan, leads the Asset-Liability Management Committee efforts, and functions as the primary regulatory contact at Civic.

Avent has a Bachelor of Business Administration from North Carolina Central University, is a Certified Public Accountant, Certified Financial Planner®, holds several insurance licenses and previously held five NASD/FINRA licenses.

In his spare time, Avent likes to travel, read and experience new adventures. He resides in Wake Forest with his wife and has three children.

"Everything at Civic must be easy to understand and easy to explain. We're trying to take the complications out of banking."

A native North Carolinian, Sherry Bear is a diehard Tarheels fan, "But," she says, "the excitement of watching the Heels is a close second to the excitement I feel about Civic helping our members."

Bear, the senior vice president of operations at Civic, has been in the credit union industry for about 34 years, holds a bachelor's degree in the Science of Industrial Relations and is also a Certified Public Accountant.

Asked about the operations side of Civic, Bear says, "Our staff is enthusiastic about developing products and services that will benefit members in their everyday lives. And we support the backbone of the organization to make sure transactions flow timely and error free."

When not working, Bear enjoys reading and traveling with her husband.

"We have the ability to build exactly what the members have asked for."

As the senior vice president of lending, Neal Chaloupka says his team's focus has been to develop great financial products for consumers, businesses and nonprofits.

"All our products are designed to maximize value for our members. In particular, Civic offers complete small business services for members who have been overlooked or underserved."

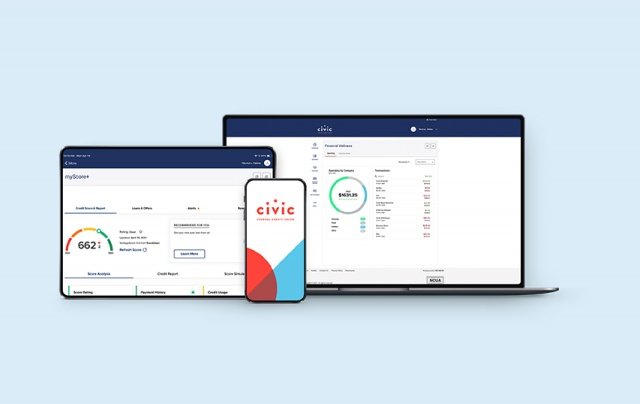

Chaloupka notes that Civic is a unique Credit Union built to meet the needs of members who want a digital-first experience.

"Members never need to go into a branch, but our help is just a phone call, a chat session, or an email away. We support members based on what they need."

A financial services professional for more than 25 years, Chaloupka has an undergraduate degree in finance from the University of Wisconsin at Milwaukee and earned his master's degree from Nova Southeastern University.

He is married and enjoys traveling in his free time.

"The vibe at Civic is like nothing I've felt before. The response from our members, the commitment of our staff and the possibilities that greet us every day — it all just inspires me."

Lamar Heyward has more than 25 years' experience in marketing, 15 of which have been in the credit union industry. He says his background in marketing, innovation and strategy culminate in his role at the helm of the Marketing Department at Civic.

Heyward says his participation in the highly-regarded Filene i3 program for innovation has helped him develop many of the marketing themes behind Civic.

"The i3 program is a framework for thinking, for forming those 'what if' ideas that seem almost inconceivable — and then trying to work them through to implementation."

Heyward notes that his daily motivation kicks up a few notches when he and his team define ideas that will help Civic members.

"We built a Credit Union with products and services that members labeled as 'needs,' 'wants' and 'love-to-haves.' As former NFL coach Jimmie Johnson says, 'The difference between ordinary and extraordinary is that little extra.'"

A veteran of the United States Air Force, Heyward earned his Bachelor of Arts in Communications with an emphasis on digital media from North Carolina State University.

Heyward enjoys spending time with his family.

“As Civic staff members, we take pride in living our mission — serving local government units, employees, family members and volunteers, to improve their lives and the communities in which they live and serve. That pride is demonstrated every day through our Core Values, which we hold dear and aspire to live by in serving our members.”

Don Larsen has more than 30 years of human resources experience across a multitude of industries including legal, engineering, software development, hospitality and financial services. He currently serves as the Chief Human Resources Officer of Civic and Local Government Federal Credit Union (LGFCU).

Additionally, Larsen is an Executive Committee member for the Credit Union National Association HR & Organizational Development Council, as well as being Chair of its Engagement Committee, and Co-Chair of its Conference Committee. He is an active member of the Forbes Human Resources Council and serves as a voluntary Board Director for the Nathan Leaf Foundation for Patient Advocacy.

Larsen has a Bachelor of Business Administration degree in Human Resources Management from Georgia Southern University and a Master of Business Administration degree.

He holds several professional certifications including the Senior Professional in Human Resources, Credit Union HR Compliance Professional, and Strategic HR Business Partner, and he is certified in Human Resources Project Management.

Larsen enjoys spending time with his wife, three adult children and two sons-in-law. When he can find the time, he enjoys playing golf and is a culinary aficionado (which really means he likes to cook and eat).

“People over profit, service over position. That’s what it means to be Civic-minded and why I’m incredibly proud to be part of a team that works with unparalleled integrity, intentionality and passion for all within North Carolina’s local government community.”

Dayatra “Day” Matthews joined LGFCU in 2012 as Senior Vice President of Legal and Compliance and was named Chief Legal Officer/General Counsel in 2021. Prior to joining LGFCU, Matthews was a partner in the Raleigh law firm of Bailey & Dixon LLP.

As Chief Legal Officer at Civic and LGFCU, she oversees all legal, compliance and risk functions and provides guidance to Executive Management and the Board of Directors on matters related to corporate governance.

Matthews graduated Phi Beta Kappa from the University of North Carolina at Chapel Hill with a Bachelor of Arts degree in political science and obtained her Juris Doctorate from Duke University School of Law.

Currently, Matthews serves as a Credit Union National Association Board of Director Class C – Nationwide and as executive leadership for the North Carolina Sister Society of Global Women’s Leadership Network. In 2022, Matthews was named one of North Carolina’s Legal Elite by Business North Carolina magazine.

Matthews is Immediate Past President of the 10th Judicial District Bar and a past President of the North Carolina Association of Defense Attorneys and its Political Action Committee. She is a former Board member of EarthShare North Carolina; former Board member and Grievance Committee Chair of the Wake County Bar Association; past President of the Capital City Lawyers’ Association; and former Board member of Movement of Youth, a Durham-based nonprofit with the mission to prepare diverse youth to lead and succeed in the 21st century.

Matthews lives in Wake Forest with her husband and son. In her free time, she enjoys playing tennis, working out, and watching her beloved Tar Heels play basketball.

“Civic was created to provide the best, most convenient services to the people who keep North Carolina communities strong. Serving them, and the communities where they live and work, is why we are here.”

Ashley Ruffin serves as Chief Impact Officer of both Civic and Local Government Federal Credit Unions (LGFCU). She joined LGFCU in 2002 as a Membership Development Officer, and later served as Senior Vice President of Marketing and Chief Strategy Officer.

Ruffin is a lifelong resident of North Carolina. Prior to joining LGFCU, she worked as the Human Resources Director for both the Town of Morrisville and the City of Sanford.

She holds a Bachelor of Arts degree in political science, a Bachelor of Science degree in administration of criminal justice from the University of North Carolina at Chapel Hill, and a Master of Public Administration degree from North Carolina State University. She is a Credit Union Development Educator and has completed various management certification programs through the Credit Union National Association and the UNC School of Government.

In her spare time, Ashley enjoys reading, kayaking, spending time with her family, and keeping up with their Boykin Spaniel pup.

“Civic represents a phenomenal opportunity to offer our members something unique and exceptional, tailored just for them and in response to what they ask for. We want to be YOUR Credit Union in every way!"

As the Chief Technology Officer of both Civic and Local Government Federal Credit Unions, Sandy Steward has made her team’s focus figuring out the future while meeting the technology needs of today.

She began her technology career in 1998, serving in the United States Navy as an Aviation Electronics Technician. Today, she is a 17-year veteran of the credit union industry holding a Bachelor of Science degree in computer information systems from Saint Leo University, and a Master of Science degree from the Florida Institute of Technology.

She has received certification from the Management and Leadership Institute offered by the National Association of Federally Insured Credit Unions.

Steward says, "The technology team goes beyond meeting the internal technology needs of the Credit Union. We work to identify and implement solutions that make it easy for our members to do business with us."

When not working, Sandy enjoys going to the movies, traveling — specifically cruising — and spending time with family.

"The entire Civic staff, as well as our members, are all part of an initiative to trailblaze the future of financial services."

As a 20-year veteran of the credit union industry, Pete VanGraafeiland received his undergraduate degree in Business Administration with a management concentration from Elon University, and earned a master's degree in Corporate Finance from Campbell University. He is also a Credit Union Certified Executive.

VanGraafeiland says the member services team, "has the privilege of interacting and assisting our members with any of their financial needs."

VanGraafeiland is married and has three young sons. He enjoys playing tennis and golf, and spending time with his family.

Leadership

This team works to serve more people and organizations from virtually anywhere. They prioritize people, purpose, and the planet.